Purchasing commercial property is a significant investment that can yield considerable returns if done correctly. However, for beginners, the process can seem daunting. From understanding the market to securing financing, several critical steps are involved in buying commercial property. This guide will break down those steps, offering a roadmap to help you make informed decisions and start your journey in commercial real estate with confidence.

Understanding Commercial Real Estate

Types of Commercial Properties

- Office Buildings: These properties range from small professional buildings to large skyscrapers and serve as workplaces for various industries.

- Retail Spaces: These include shopping centers, malls, and standalone stores where businesses sell goods directly to consumers.

- Industrial Properties: Warehouses, manufacturing facilities, and distribution centers fall under this category, primarily supporting production and logistics.

- Multifamily Housing: While often residential in nature, multifamily housing like apartment buildings is considered commercial when the property has five or more units.

- Special Purpose: These are properties designed for specific uses, such as hotels, hospitals, or entertainment venues.

Researching the Market

Factors to Consider

- Location: Proximity to transportation, customer base, and business centers can significantly affect a property's value.

- Economic Indicators: Look for areas with low unemployment rates, high population growth, and a strong local economy.

- Market Trends: Understanding whether the market is currently favoring buyers or sellers can influence your purchasing strategy.

Finding Local Market Data

Financing Your Purchase

Types of Commercial Real Estate Loans

- Traditional Bank Loans: These loans are similar to residential mortgages but often require a larger down payment (typically 20-30%) and have shorter repayment terms.

- SBA Loans: Backed by the Small Business Administration, these loans are designed for small business owners and offer competitive rates and longer repayment terms.

- Private Loans: These are offered by private lenders or investors and often have more flexible terms, though they may come with higher interest rates.

Preparing for Financing

Conducting Due Diligence

Key Areas of Due Diligence

- Property Condition: Hire a professional inspector to evaluate the property's physical condition, including the structure, systems, and any potential environmental issues.

- Zoning Laws: Ensure the property is zoned for your intended use, as local zoning laws can restrict certain business activities.

- Lease Agreements: If the property has existing tenants, review the lease agreements to understand the rental income, tenant responsibilities, and lease terms.

- Financial Records: Examine the property's financial records, including income statements, operating expenses, and tax returns, to assess its profitability.

Negotiating the Purchase

Key Considerations During Negotiation

- Purchase Price: Aim to negotiate a price that reflects the property's current market value and future income potential.

- Financing Terms: If you're financing the purchase, negotiate favorable loan terms, including interest rates, repayment periods, and any prepayment penalties.

- Contingencies: Include contingencies in the purchase agreement that allow you to back out of the deal if certain conditions aren't met, such as financing approval or satisfactory inspection results.

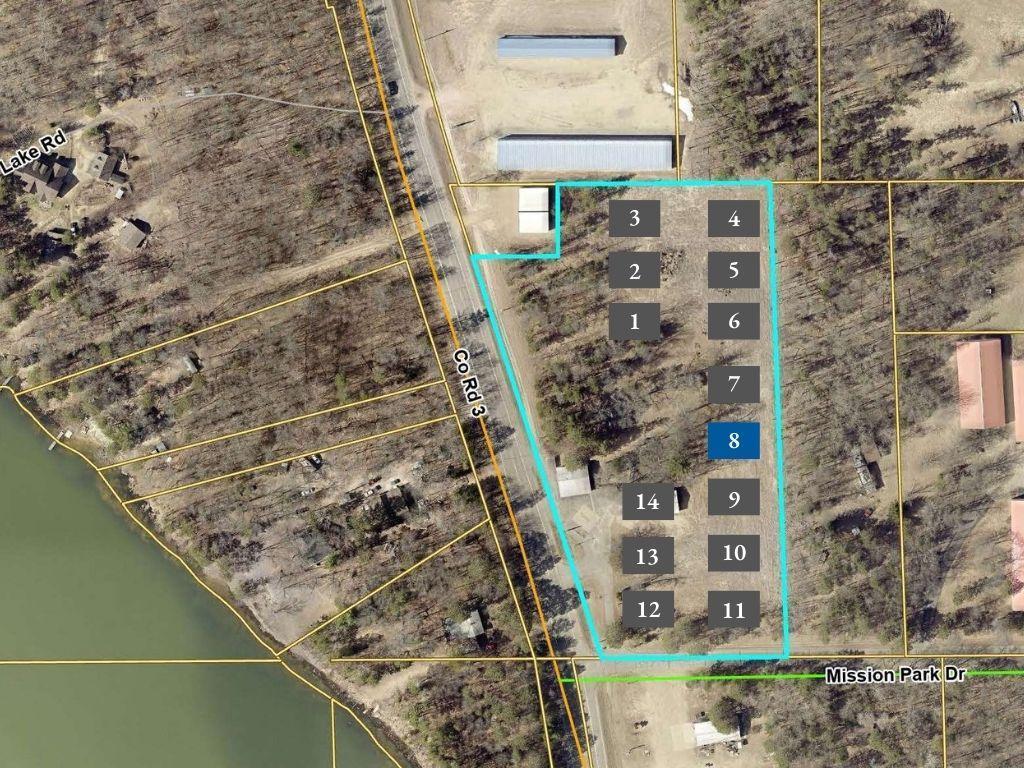

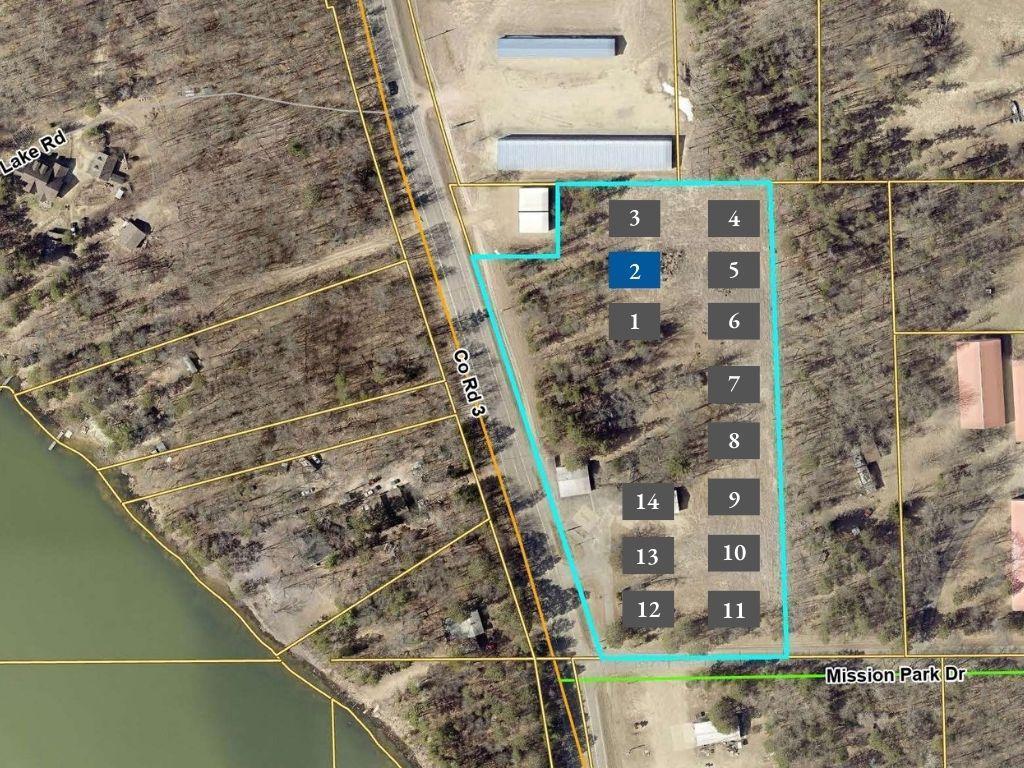

Take the Next Step with The Larson Group

If you're considering investing in commercial property in Crosslake, MN, reach out to the Larson Group for expert guidance and support. With their extensive experience in the local market, they can help you find the perfect property to meet your business needs. Contact the Larson Group today to begin your commercial Crosslake real estate journey.